What is Repo Rate?

The repo rate refers to the rate at which the Reserve Bank of India (RBI) lends to commercial banks (for the short term) using government securities as collateral (for the short term). In simpler terms, banks may borrow money from the RBI at the repo rate in order to cover their day-to-day cash flow shortages.

- If the repo rate is increased, it is more expensive (costlier) for banks to borrow. Therefore, it is also likely for the loan interest rates (that are charged to customers) to increase. Example; home loan, personal loan, etc. This is a mechanism to reduce (to help cool down) inflation.

- If the repo rate is decreased, it is likely that banks may borrow at a cheaper rate. Which tends to lead to a decrease in the interest rates charged to borrowers. This in turn tends to increase (to boost) the rate of spending and therefore, economic growth.

This is one of the main tools available to the RBI in controlling the inflation rate. And the cash flow (liquidity) in the economy.

What is present Repo Rate?

The current repo rate in India is at 5.25% for the year after the Reserve Bank of India adjudicated the rate down by 0.25% in the Dec 2025 MPC meeting.

This is the 5th and final adjudication for 2025 amounting to 1.25%. The repo rate cut now places the repo rate at its lowest level in the last 2.5 years, reducing borrowing costs for home, automobile, and unsecured loans linked to the repo rate.

Current Repo Rate and Reverse Repo Rate

The reverse repo rate in India is 3.35% while the current repo rate is 5.25%.

- At the December 2025 MA Policy Committee Meeting repo rates dropped 5.50% in into penalties by 25 bps to 5.25%.

- The reverse repo rate is still 3.35%. This is the rate which the RBI borrows funds from the commercial banks which is usually lower than the rate for repo.

Repo Rate Historical Chart

The Reserve Bank of India has published complete historical changes over time of the repo rate with much of the finance world converting them into user-friendly charts and graphs. Over the long run, as of the year 2000, India repo rate has oscillated between a maximum rate of close to 16% in the year 2000. A minimum rate of 4% in the Covid period before rising to 6.5% in the years 2022 and 2023. Then moderating to 5.25% in the year 2025, December.

Your Home Loan EMI is About to Get Cheaper

Starting December 2023, other banks will begin following the Reserve Bank of India’s unprecedented decision and the broader measures adopted by the banking sector, a move that is expected to set the market trend for the coming years. Slashing home loans and offering to ease payment schedules.

Several major home loan providers: HDFC Bank, PNB, Indian Bank, and Bank of Maharashtra have started easing home loan payment rates, to give relief to distressed, and to homeowners in particular, to reduce significantly their home loan payments per month. For floating-rate loans, lenders are expected to reduce home loan EMIs significantly.

Borrowers will save in the range of 3000 to 4000 rupees per month in repayment of housing loans on amounts of around 50 lakh.

This guide will show you to what extent reduction in rates will reduce your home loan EMI, what banks have the home loans on the lowest rates, and to what extent you will need to find more savings and get better savings when you have better financial in order to have better financial savings.

The Impact of RBI Cuts Repo Rate on Home Loan.

The RBI Monetary Policy Committee has decided to lower the policy repo rate from 5.50% to 5.25%. This was a 25 basis point decrease due on December 5, 2025. This is the 4th consecutive decrease for 2025, resulting in a cumulative decrease of 125 basis points in the last 10 months. Such aggressive rates is a sign of the RBI’s trying to stimulate economic growth as inflation has dropped to 1.7%.

The impact on immediate home loan EMI depends on how lenders structure the loan. Most lenders link home loans to the repo rate, so you will receive the initial, direct, and relatively quick relief. The RBI has mandated that banks link all retail loans to the repo rate as it ensures immediate transmission of rate cuts to borrowers.

On a four million home loan taken out at 9% interest over a twenty year tenure, each 25 basis point decrease in interest rates directly equates to a saving of roughly 1,000 to 1,200 rupees in monthly EMI. This significantly helps in terms of budgeting.

Banks That Are Reducing Home Loan Interest Rates

Indian Bank: First Moving

Being one of the first public sector banks to benefit from the RBI rate cut, Indian Bank used the opportunity to Lower the Bank’s Repo Link Benchmark Lending Rate (RBLR) from 8.20% to 7.95% w.e.f. 06 Dec. 2025. Clearly a benefit to customers. Indian Bank also reduced its one year MCLR by 5 bps to 8.80%. Then for borrowers to pass on the benefits with differing structures, and in two separate benefits. Borrowers with Floating-rate Home Loans will directly benefit from the rate cut, as a lower Borrowers will benefit from the rate cut, as a lower

The lender will reset their loans based on the contract terms or the anniversary of the loan.

PNB Cuts Home Loans Interest Rates by 25bps.

In line with the rate cuts made by the Reserve Bank of India, PNB has reduced their Repo-Linked Lending Rate (RLLR) by 25bps (from 8.35% to 8.10%). This rate cut will come into effect December 6, 2025. With this rate cut, PNB ensures they are assisting their borrowers as best as they can with this rate cut. PNB noted that it reduced the RLLR, while it will keep the MCLR and Base Rates unchanged. This means customers with closed loans will have the option of choosing which benchmark is more favorable for them.

PNB resets home loans for its borrowers every three months. Therefore, for resets done during the month of October will see the rate cuts in their January 2026 EMIs, which is a great way to start the new year.

HDFC Bank Cuts Home Loan Interest Rates

During the month of November 2025, HDFC Bank has been the first to reduce the lending rates with a variety of MCLR reductions. Banks have reduced MCLR rates by 0-10 bps, so borrowers with MCLR-linked home loans will benefit from lower EMIs as their loan anniversary dates approach.

HDFC Banks home loan interest rates are between 7.90% to 13.20% depending on the borrower.

To calculate the interest on loans, lenders take the repo rate into consideration and add a range of 2.4% to 7.7% on the repo rate to get the final interest on the loan depending on the credit profile of the borrowers.

Bank of Maharashtra: 7.10% is the Lowest

For the first time in the public sector, the Bank of Maharashtra made the first public sector bank to announce home loan rates starting from 7.10% from December 5, 2025. This rate move is in line with the support to homebuyers in the time of high housing rates. The bank also cut rates on car loans to 7.45%, as they’re also providing rate relief on other loan categories.

The bank cut rates on home loans as a part of the strategy as a means of developing a competitive advantage in the home loan market, since price is the determining factor in the market currently.

Other Banks are Now Following the Price Leader

Other banks have also started following the price leader in this case. Bank of India and other banks have started charging home loan rates starting from 8.10% and other public sector banks like Union Bank of India, Canara Bank, and Central Bank of India are charging home loan rates starting from 7.35%- 7.45 % for the first time since the covid 19 pandemic.

| Bank Name | Current Starting Rate | Effective Date | Rate Cut (bps) |

|---|---|---|---|

| Bank of Maharashtra | 7.10% | Dec 5, 2025 | 25 |

| Indian Bank | 7.95% (RBLR) | Dec 6, 2025 | 25 |

| PNB | 8.10% (RLLR) | Dec 6, 2025 | 25 |

| Bank of India | 8.10% (RBLR) | Dec 5, 2025 | 25 |

| Central Bank of India | 7.35% | Ongoing | 25+ |

| HDFC Bank | 7.90%-13.20% | Ongoing | 10 (MCLR) |

| SBI | 7.50%-8.70% | Ongoing | Under review |

| Canara Bank | 7.40%-10.25% | Ongoing | 25 |

Home Loan EMI Calculation: Real-World Savings Examples

Very basic EMI calculations can help one understand the implications of the rate cuts in your case. Let us consider the following practical examples to illustrate the potential savings due to rate cuts:

Scenario 1: Home Loan of 50 Lakhs For 20 Years

When the interest rate was 8.50%, the monthly EMI was 43,391. With the expected 50 basis point cut in rates, the EMI will be right down to 41,200, saving one 2,200 every month.

If later, one was to prepay the loan, one due to reduced EMI might complete the loan approximately 19 months earlier. However, if one did this, to sustain the same EMI one would make the loan term smaller which would be to savings of 619000 rupees. Also, this strategy would result in the discipline of higher cash flow to sustain, however, much higher rupees savings would be.

Scenario 2: Home Loan of 75 Lakhs For 20 Years

Fast savings was also seen from 75 lakh loan 8.50% of the interest, EMI was 65,086. After 50 basis point of rate cuts, the EMI is down to 62,350, which would mean savings of 2,736 monthly. Also, if one is to make the loan term 22 months earlier to sustain the same loan itself would lead to much savings of 12.3 lakh in total interest saving over the loan.

Scenario 3: Home Loan of 1 Crore For 20 Years

1 Crore is a cop up. It is also more lending with high EMI.

With respect to the earlier principal amount of ₹86,782 at an 8.5% EIR, the principal amount has diminished over the months to ₹83,500. This new EIR results in a monthly principal reduction of ₹3,282 at a rate of 8.0% EIR. In other words, the borrower is saving ₹3,282 every month.

In the event of a borrower opting for a reduction in the remaining term of the repayment schedule, the borrower will eventually save a total of ₹16.40 lakhs in total interest over the tenure of the loan, which will now take quarterly repayments. The loan will now be completed 22 months earlier than its original repayment schedule.

How to Benefit from Home Loan Rate Cuts: Strategic Planning Guide

For Existing Borrowers with Repo-Linked Loans

If you are on Repo Rate linked Home Loan scheme, you are at the best position to gain from current RBI rate cuts. For most banks, the rate resets on a quarterly basis (every three months) on the anniversary of the last reset. Review documentation to confirm the rate reset date for your loan which might be around the anniversary date or certain predefined quarter-end dates.

Action Items:

- Keep in touch with the lender to confirm the rate reset date.

- Estimate potential EMI savings using the EMI savings calculator provided by the bank.

- Choose between decreasing EMI (the cash flow becomes easier) or decreasing tenure (more savings in the long run).

- Consider refinancing if the bank has not fully passed the rate change.

For Borrowers on Loans Based on MCLR Rate

If you are on MCLR (Marginal Cost of Funds based Lending Rate) based EMI, the rate transmission effect is relatively slow.HDFC Bank recently reduced its MCLR by 10 basis points, so this reduction will flow through, but the bank’s internal policy cycle will dictate the timing.

Action Items:

- Keep a close eye on your bank’s MCLR rate as they will report it on their official site.

- Confidently ask your relationship manager about the current schedule for your next rate reset.

- If the MCLR spread is not favorable to you, consider switching to a repo-rate linked loan.

- When doing comparisons, look at the impact of switching loans at the processing fees to see if you are saving any money.

If you plan to get a new home loan in the upcoming months, you are entering a very good home loan market. Current rates are at a historical low and are in the range of 7.10%-7.50% for borrowers that are well qualified. To put in layman terms, this represents the good times to get home loans in recent years.

Things To Do Now:

- Make a comparison of the rates of the top three banks: Bank of Maharashtra, Indian Bank, and PNB.

- Make sure your credit score is at a minimum of 750 to secure the lowest advertised rates.

- Obtain pre-approval for a mortgage before you apply for any property to show that you are serious.

- Due to the fact that the RBI is unlikely to further cut rates beyond the expected cut of December 2025, you should lock in rates at the earliest possible convenience.

Understanding the Various Mechanisms of Rate Transmission

Repo Rate Linked Loans: We get the fastest suite of loan products

Home loans that are linked to the RBI repo rate get the fastest suite of loan products. When the RBI cuts the repo rate by 25 basis points, the lender’s repo-linked lending rate (RLLR) get’s reduced, if only by a little less than 25 basis points. This has already started to happen, Indian Bank, PNB and Bank of India have all announced a 25 basis point cut in the RL, but only a day after the RBI announcement, and all in total, they have all announced that they reduced their RLLR by 25 basis points.

The EMI rate cuts are determined by a loan reset frequency of typically three months.

MCLR-Linked Loans: Slower, Variable Transmission

MCLR-linked loans will experience transmission at a slower rate. Banks indirectly impact MCLR, but they determine MCLR themselves from the cost of funds, the operational expenses, and the internal pricing strategies. Therefore, a 25 basis point repo cut could equate to 10 to 15 basis point decrease in MCLR, but that will heavily depend on the lender.

An example would be HDFC Bank, which illustrates this pattern of slower transmission by decreasing MCLR by 10 basis points on some of the tenures. If your home loan EMI is MCLR-linked, don’t expect to receive the full benefit of the rate cut at the same time as the decrease.

Fixed-Rate Home Loans: No Benefit from Current Cuts

Because borrowers that have chosen a fixed-rate home loan have their interest rate capped, they will receive no benefit from the subsequent cuts by the RBI. While having a fixed-rate home loan protects borrowers from rate increases, the market makes having a fixed-rate loan less favorable.

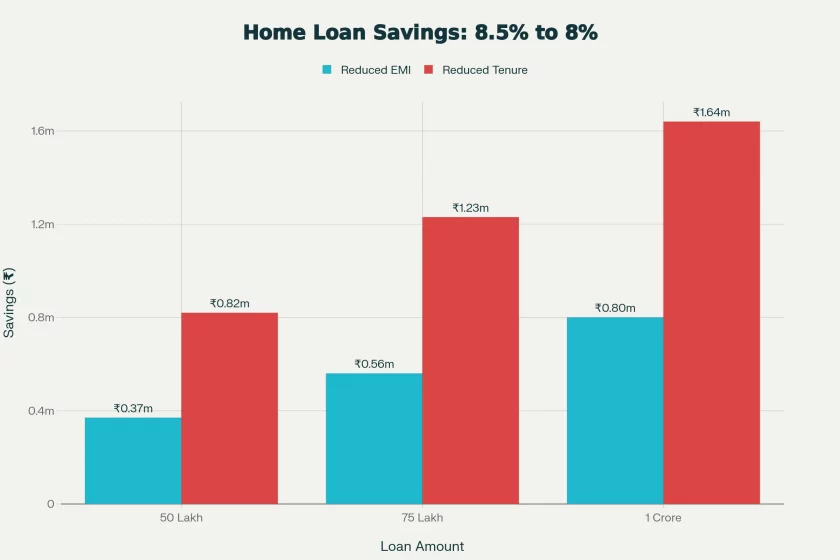

Reduced EMI vs Reduced Tenure: Which One Should You Choose to Save More?

After the interest rates change for home loans, most banks recalibrate the EMI and automatically reduce the tenure without modifying the EMI amount, as this would lead to a longer tenure relative to the amortization schedule. But you can decide to not follow this. It is important to consider the consequences of each strategy to facilitate a higher-order wealth management.

Recommended Cash Flow: Reduce Tenure Strategy

When you do not change the EMI but allow the tenure to be reduced, you pay off your loan sooner and incur significantly lower interest payments. If the loan amount is 50 lakhs, it costs ₹8.2 lakhs in interest. If the loan amount is 75 lakhs, it costs ₹12.3 lakhs in interest, and for a loan amount of a 1 crore, it costs ₹16.4 lakhs in interest.

There is an even more important psychological advantage: the home can be owned debt-free many years sooner, and this is a significant relief. It also provides flexibility for other activities, such as retirement, education for children, or other major projects and activities.

Reduce EMI Strategy (Recommended for Budget Constraints):

If your income has remained the same, cash flow will increase and there will be some financial breathing room due to the lower monthly EMI. The savings for the same loan amounts are lower, but still significant. It’s a savings of ₹3.7 lakh (50 lakh), ₹5.6 lakh (75 lakh), and ₹8 lakh (1 crore).

If you have other investments, this is the most ideal situation. Other investments can yield a greater return than the rate of your home loan. This also goes if you’d like to use the cash to help for children’s education, business, or even emergency funds.

How Soon You’ll See The Lower Home Loan EMI

There are many reasons concerning the loan that determine how rate cuts will equal lower monthly payments.

Rate Reset Schedule. The standard for banks is to reset rate policies quarterly. See loan for exact reset date. For example, if your most recent reset was in October, expect changes in January. If November, expect changes in February.

Loan Linking Mechanism. If the loan is repo linked, expect changes more quickly (25-30 days). If linked to MCLR, the changes will take 45-60 days after the banks’ internal policies.

Bank Processing Speed. Larger banks like HDFC Bank, ICICI Bank, and SBI tend to have procedures in place for faster adjustments than smaller, less established banks which can take a fair amount of time.

Communication Protocol. Some banks communicate with borrowers beforehand, while others require borrowers to reach out first. Being proactive guarantees that you receive the benefits right away.

Opportunities for Refinancing and Switching Rates

It may be to your strategic advantage to refinance with a different bank, especially, if your current bank is slow to implement rate cuts. Loans to you at the rate of 7.10%-7.45% is a huge savings compared to your current loans to you at 8.5%-9% rates.

Refinancing Factors to Consider:

- Loan processing fees typically range from 0.5%-1% of the outstanding loan amount.

- If you are leaving your current lender, you may be subject to a prepayment penalty.

- Consider the cost of switching lenders to the savings you will realize over the life of the loan.

- Check the new loan for rate lock-in period and if it has flexible terms.

- If you have a 50-lakh outstanding balance, refinancing fees of ₹25,000-₹50,000 is a good investment if you will save ₹5,000+ each month, which you will realize within 5-10 months of getting the lower rate.

Consequences on Real Estate and Housing Affordability in India

The effect of the ongoing rate cuts is being felt in the housing sector of India. More loans are being taken out as EMIs are falling to levels seen earlier in the panedmic. While housing prices are rising (10 percent across popular cities in 2025), consumers are still able to make housing purchases. Affordability is not an issue.

Many professionals in the real estate sector believe that the cuts in interest rates will lead to an increase in demand of the affordable and mid-income housing as that is the sector where the borrowers are most impacted by the lower EMIs. At the same time, banks enjoy the benefits of having higher quality loans on their portfolios as lower EMIs will result in improved default rates.

Plan of Action: Activities to Undertake Immediately

Directives for Action: THIS WEEK

- Retrieve your latest mortgage statement and find the method your loan is linked to: repo, MCLR, or fixed.

- Look at your loan agreement to estimate the date of the next loan rate adjustment for your mortgage.

- Look for any announcements of rate reductions by your lender.

- Estimate the amount you would owe monthly by using the loan simulation tool, which banks commonly offer.

Actions To Be Undertaken THIS MONTH:

- Reach out to your bank’s relationship manager to determine how long the bank takes to apply a rate reduction.

- If your financial institution has not lowered rates in light of the new policy rate, then you should make a formal request for an adjustment to the interest rate on your loan.

- Collect interest rate quotes from other banks.

- Determine the accurate costs of refinancing your mortgage if you find significant cost savings in switching banks.

Actions To Undertake OVER TIME

- Every 3 months, check the policy rate set by the Reserve Bank of India to identify future opportunities to refinance.

- Keep your credit score above 750, which enables you to continue accessing the lowest interest rates in the future.

- If your spending habits allow for it, think about lowering your monthly payments by shortening your mortgage term instead of just reducing your monthly payments.

- Continue actively managing your loan to ensure it is settled early.

The Most Frequently Asked Questions Regarding The Reduction of Home Loan EMIs

Final Thoughts: Saving the Most on Your Home Loan

Currently, there is a generational opportunity for home loan borrowers due to the shift in the rates environment. The average home loan borrower has qualified for a loan with HDFC Bank, PNB, Indian Bank, Bank of Maharashtra, and many more is able to cut rates for a savings opportunity of hundreds of thousands of rupees.

To save the most money, you must fully understand how your loan structure works. This includes monitoring the rate reset dates. From there, you must make a decision to lower your EMI or your loan tenure. The time to make that decision is now, whether you’re an existing borrower with the benefit of lower home loan EMI or a new home buyer.

Purchasing a home is a significant financial decision for most Indians. With the current environment, you can reduce your monthly payments while repaying the loan, and save a large amount of interest money. For many, this means they can build generational wealth much more quickly and effectively.