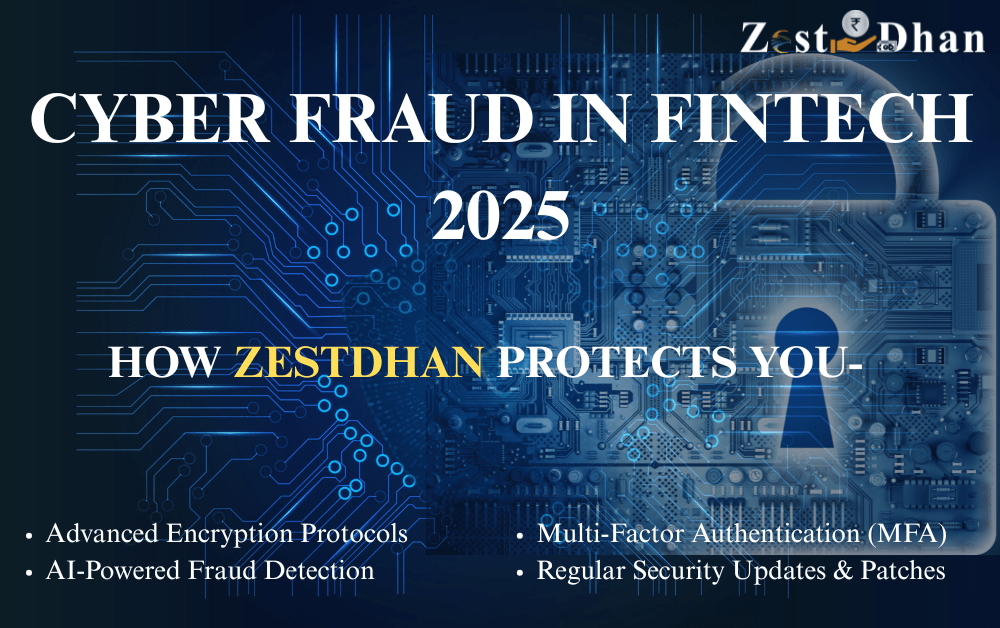

Cybersecurity in Fintech 2025: RBI’s Zero‑Trust Mandate Explained

Money ManagementCybersecurity in Fintech 2025: RBI’s Zero‑Trust Mandate Explained Introduction: Fintech’s Rising Cyber Threat Landscape In 2025, India’s fintech sector is booming, but so are cyber threats. With billions of transactions happening online, the Reserve Bank of India (RBI) has tightened security norms for digital finance companies. The rising fintech security trends India show that traditional […]