Are you a regular traveler looking for luxurious stays and global privileges that don’t put a dent in your pocket? The HDFC Marriott Bonvoy Credit Card could be ideal for your travel and spending habits. In this easy-to-follow guide, you will find everything you need to know about this hotel co-branded credit card, including its features, benefits, eligibility criteria, and its one-of-a-kind rewards program.

What Is The HDFC Marriott Bonvoy Credit Card?

The HDFC Marriott Bonvoy Credit Card is a product of HDFC Bank and Marriott International, and is designed to serve the needs of luxury and travel enthusiasts through its unique features. This card combines the strengths of banking and travel industry to serve high-value customers who wish to earn travel rewards in addition to hotel stays and premium lifestyle spending.

Key Features & Benefits

At a Glance – HDFC Marriott Bonvoy Credit Card

| Feature | Details |

|---|---|

| Annual/Joining Fee | 3,000 INR + GST |

| Welcome Benefit | 1 Free Night Award (up to 15,000 points) |

| Renewal Benefit | 1 Free Night Award on card renewal |

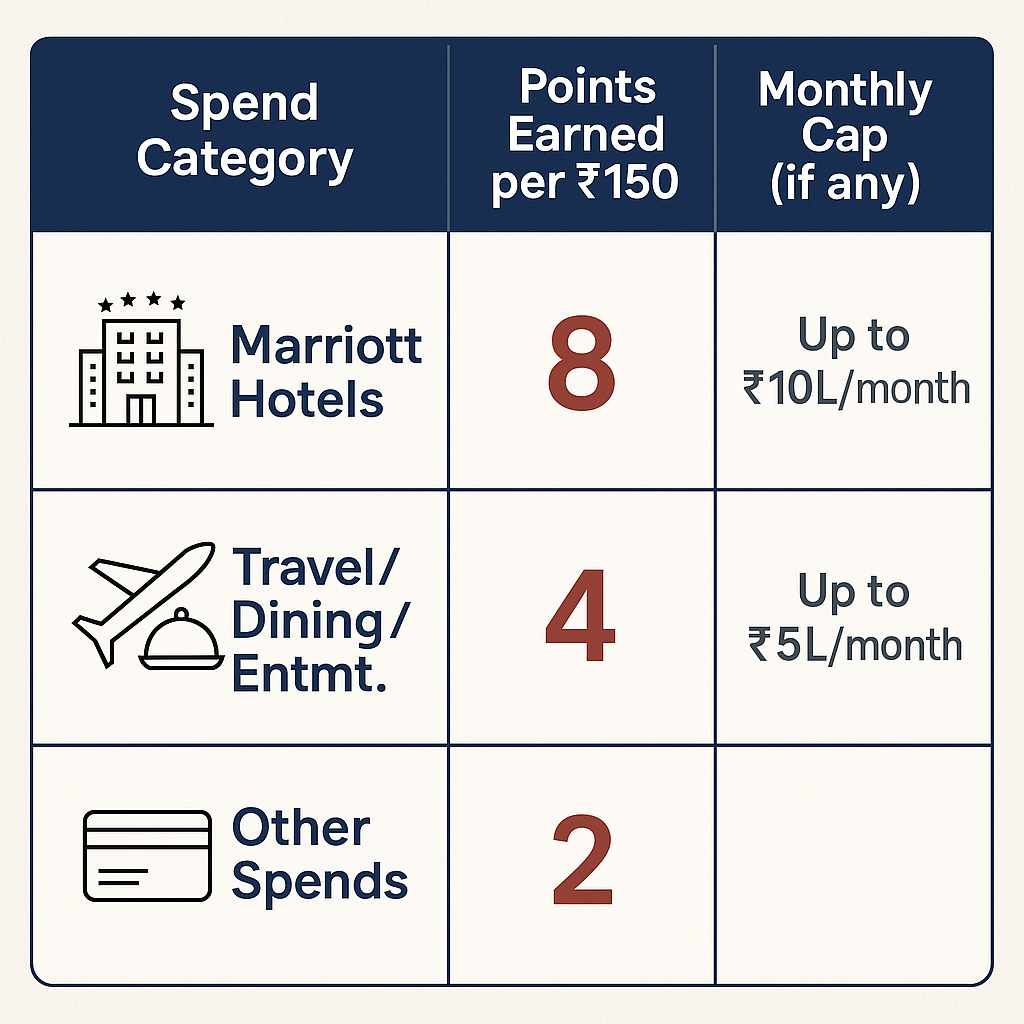

| Reward Points | • 8 Points/₹150 at Marriott Hotels • 4 Points/₹150 on travel, dining, entertainment • 2 Points/₹150 on other spends |

| Silver Elite Status | Complimentary |

| Lounge Access | 12 Domestic & 12 International per year |

| Golf Access | 2 Green Fee waivers/quarter |

| Milestone Rewards | Up to 4 Free Night Awards (on ₹6L/₹9L/₹15L spend) |

| Insurance | Air Accident, Medical, Baggage, Passport Loss |

| Foreign Markup | 3.5% |

| Interest Rate | 3.6%-3.75% per month |

1. Rewarding Your Every Spend

8 Points per ₹150: Earn points quickly when spending at Marriott Bonvoy hotels.

4 Points per ₹150: Dining, entertainment, and travel will also yield points.

2 Points per ₹150: All other eligible spending.

Bonus Points Offers: There are promotional periods during which you can earn up to 10,000 points, which are awarded for high spending.

2. Exclusive Hotel Privileges

Free Night Awards: Up to 3 extra free nights can be awarded for reaching certain spending milestones (6, 9, and 15 lakh) plus 1 awarded on joining and renewal.

Complimentary Silver Elite Status: Get bonus points, priority check-in, late check-out, and other Marriott Bonvoy program perks.

10 Elite Night Credits: Helps you level up faster within the Marriott Bonvoy program.

3. Airport & Lifestyle Perks

Unlimited Luxury: Every Travelperk users get 12 free accesses each to omnichannel airport lounges both domestic and international.

Golf Privileges: 2 green fee waivers and 2 free lessons each quarter at select clubs around the globe.

4. Insurance Coverage

Great for global travelers with Air Accident Cover, Emergency Medical, Baggage Loss, Travel Document Loss, Flight Delay, and Credit Shield.

5. Additional Features

Zero lost card liability: Protects you financially in case of loss or theft.

Easy redemption: Marriott Bonvoy properties allow seamless point redemption for room nights, upgrades, dining, and spa services.

Spending Gives You Benefits

Redemption: 1 Free Night Award (up to 15,000 points) given as welcome/renewal bonus. Up to 3 additional free nights on milestone spends of ₹6L/₹9L/₹15L in an anniversary year.

Eligibility Requirement for Marriott Bonvoy Credit Card

| Eligibility Requirement | Salaried | Freelancing |

|---|---|---|

| Age | 21-60 years | 21-65 years |

| Minimum Income | ₹1L/month (net) | ₹15L/year (ITR) |

| Nationality | Indian | Indian |

HDFC Bank’s approval is based on singular judgment. KYC and other documents needed.

Fees and Charges

- Joining & Annual Fee: ₹3,000 +GST with no annual waiver

- Foreign Currency Markup: 3.5%

- Interest Rate: ~3.6% per month (~43% per annum)

- Late Payment Fees: As per latest HDFC Bank terms

Pros and Cons

| Pros | Cons |

|---|---|

| Premium hotel benefits & Complimentary airport lounges and golf access. | No annual fee waiver available. |

| Free night awards with stay. Automatic Silver Elite status in Marriott Bonvoy. | Points not awarded on certain spends. |

*No points on: fuel, EMI, wallet loads, cash advances, rent, fee payments, government transactions, etc.

How Does It Compare?

| HDFC Marriott Bonvoy Card | Axis Magnus | SBI Card ELITE |

|---|---|---|

| 8 pts/₹150 @ Marriott Hotels | 6 pts/₹200 | 2 pts/₹100 General |

| Free Night Awards | Travel Vouchers | Club Vistara etc. |

| 12+12 Lounge Access | 8+6 Lounges | 8+6 Lounges |

| ₹3,000 Fee | ₹10,000 | ₹4,999 |

| Best Suited For: | Travel/Reward | Miles/Tier Points |

| Luxury Hotel & Frequent | Seekers | Seekers |

Redemption: how to use your points

- Redeem Points: Book free nights and upgrades at 7,000+ Marriott Bonvoy hotels worldwide.

- Flexibility: You can redeem points to pay for hotels, restaurants, spas, and other services under the Bonvoy System.

- Validity: Earning and redeeming points allows Marriott Bonvoy to not expire points within a 24 month system.

Is the Marriott Bonvoy Credit Card Useful for You?

- Frequent travelers: Best for people who regularly stay at a Marriott and want to earn hotel rewards faster.

- Luxury Seekers: Great for people who love free night stays, lounge access from Marriott and other airports, and international golf access.

- Not for: Users with low spend limits annually, or cashback cards where spending a set amount a year waives the fee.