There may be times when you have to utilize loans to achieve various financial and life goals. Whether it is buying a house, buying a car, or funding education, it all needs a significant amount of money. However, committing to a loan requires a lot of understanding and planning on one’s part. This can be made easy with features like an EMI calculator.

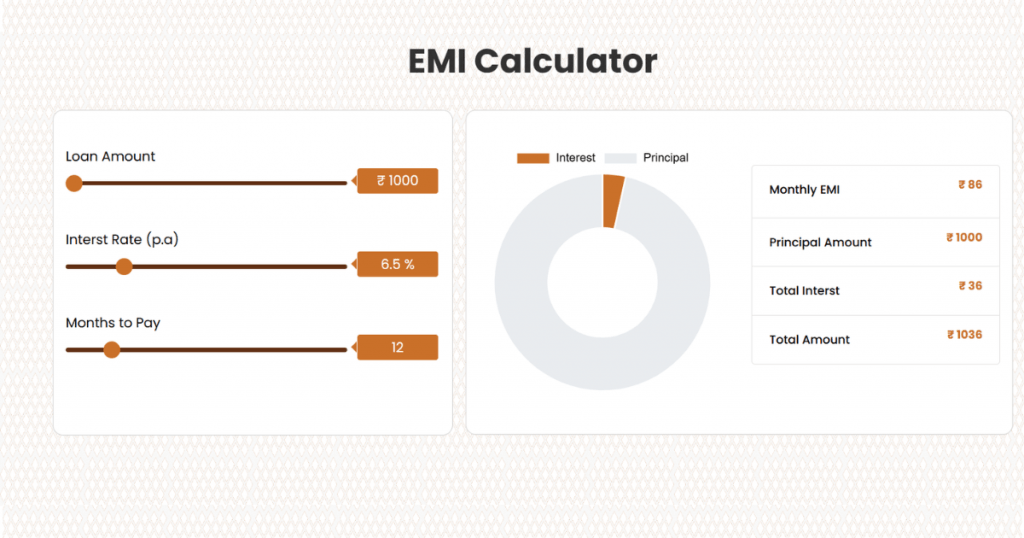

The available EMI calculator online gives you a clear idea of the repayment amount. It uses data like Principal Amount, Interest Rate, and Loan Tenure to calculate the result. By leveraging these calculators, one can make borrowing a hassle-free experience. If you wish to learn how using these calculators can aid in financial planning, check the given reasons!

1. Budgeting & Expense Management

When you use an EMI calculator it allows you to indulge in effective budgeting. Managing your expenses, especially when planning to take out a loan, is essential. This ensures that you do not over-borrow.

Example:

An individual plans to take a home loan of 50 lakhs at an 8% rate. The loan tenure is 20 years. By using a home loan EMI calculator the individual can figure out the monthly installment. This way, he or she can adjust the tenure or amount.

2. Loan Comparison & Selection

There are many financial institutions and various loan products available in the market. These loans have different interest rates and repayment terms. All the available options can easily be compared by using any EMI calculator.

Example:

There are two banks a borrower is considering for a personal loan. First for 5 lakhs at 11% and second for 5 lakhs at 13%. The tenure for both loans is 5 years. By using a personal loan EMI calculator the borrower can identify the exact amount of interest.

3. Loan Tenure & Interest Impact

An EMI calculator can allow you to compare between two different loan tenures. A loan duration can have a significant impact on the interest rate. It is always better to calculate and opt for a shorter duration.

Example:

One can use a car loan EMI calculator to compare durations of two different kinds. Imagine considering a loan worth 10 lakhs at 9% interest. But the duration available to choose is 5 years and 7 years. Here is what you end up paying:

- 5-year tenure EMI: INR 20,000, where total interest paid is INR 2,45,630

- 7-year tenure EMI: INR 16,077, where total interest paid is INR 3,51503

By comparing the two options, one understands that the shorter duration makes you pay less interest.

4. Financial Strain & Defaults

Borrowing a loan without proper financial planning can lead to distress and possible default. With an EMI calculator, you can assess your repaying capacity in advance. This will keep you from committing to obligations beyond your financial capacity.

Example:

A borrower has a monthly income of INR 50,000. The loan they are considering taking has an EMI of INR 30,000. When you use a PL loan EMI calculator, you can understand the EMI structure and ensure you stay within budget.

5. Loan Prepayment Planning

No borrower wants to be stuck with a debt for a very long time. Prepayment or part-payment is an option that can significantly reduce the burden of interest. But to be able to plan properly, you have to use features like an EMI Calculator. This allows you to adjust the repayment schedule.

Example:

For instance, a borrower plans on repaying INR 1 lakh annually towards his loan. By using a calculator, the borrower can see how the loan tenure is being reduced and the pending interest cost. This will allow the borrower to plan for prepayment.

When you think, an EMI calculator is a feature that can simplify loan-related calculations. It can not only enhance your financial planning in the given ways but also many others. For instance, it can support borrowers in making smart investment decisions. Using a similar calculator can even assist with credit score management. So, the next time you plan on borrowing funds be sure to use an EMI calculator.